Dreaming of escaping the 9-to-5 grind and owning your own business? Buying an existing business seems like a safer bet than starting from scratch, but countless pitfalls await the unwary. In "21 Stupid Things People Do When Trying to Buy a Business," David Barnett, a seasoned business broker, reveals the common mistakes novice buyers make, saving you from costly errors. This second edition, packed with real-life case studies and bonus "stupidities," guides you through the process, helping you identify inflated prices, avoid disastrous deals, and ultimately, make a smart investment or know when to walk away. Learn from others' failures and secure your entrepreneurial future.

Review 21 Stupid Things People Do When Trying to Buy a Business

Let me tell you, if you're even remotely considering buying a business, "21 Stupid Things People Do When Trying to Buy a Business" by David Barnett is an absolute must-read. Forget those fluffy, overly-optimistic guides that paint a rosy picture of entrepreneurship – this book gets straight to the point, laying bare the common pitfalls that can sink even the most well-intentioned buyer.

What I really appreciated is Barnett's no-nonsense approach. He doesn't shy away from using industry jargon, which might initially seem intimidating, but honestly, that's part of the learning process. Encountering these terms early on forces you to research and understand them, building a solid foundation of knowledge right from the start. I've actually taken a different business-buying course, and this book cleverly reinforces and expands on much of what I learned there – providing a different perspective and additional insights.

The author's real-world experience shines through on every page. This isn't some theoretical treatise; it's a collection of hard-won lessons learned from years of observing the ups and downs of business transactions. Barnett paints a realistic picture, emphasizing that buying a business is serious business – not some get-rich-quick scheme. He constantly stresses the importance of due diligence, comparing the process to buying a used car: you're inheriting someone else's headaches, and you need to be prepared.

Unlike many books that promise easy riches, this one highlights the potential downsides and equips you to navigate them. It's like having a seasoned mentor guiding you through the minefield of business acquisition. The author makes it clear that the goal is profit, and not just any profit – keeping the profit. He doesn't sugarcoat the difficulties; instead, he provides practical advice on how to avoid costly errors and secure a profitable venture.

The book's structure is clear and easy to follow, making it accessible even to those with limited business acumen. The examples and case studies are particularly helpful, illustrating the consequences of common mistakes in a relatable and memorable way. Rather than simply telling you what not to do, the book empowers you to deduce the correct actions by understanding the negative outcomes.

Honestly, I found the book incredibly valuable. It's the kind of knowledge that usually takes years to acquire through trial and error, but Barnett condenses it into a concise and easily digestible format. The information presented is vital, not just for aspiring business owners, but for anyone seeking a practical understanding of the business world in general. If you're serious about buying a business – or even if you're just curious about the process – this book is a worthwhile investment that could save you a substantial amount of money and heartache in the long run. It's a clear, concise, and essential guide, and I wholeheartedly recommend it.

Information

- Dimensions: 6 x 0.27 x 9 inches

- Language: English

- Print length: 118

- Publication date: 2024

Book table of contents

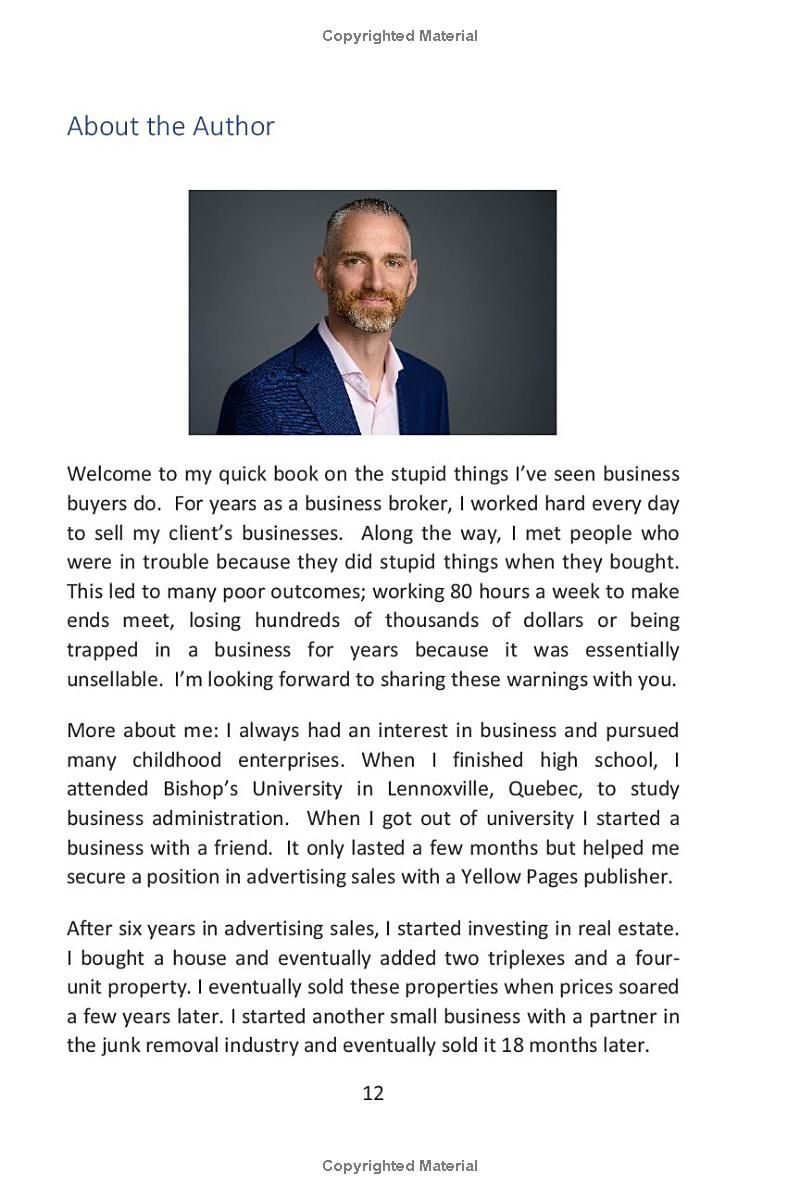

- About the Author

- Failing to understand how businesses are valued

- Failing to account for the value of their labor

- Failing to account for the value of capital

- Over-committing projected free cash flow to debt service

- Failing to adjust for operating capital.

- Failing to understand operating capital for 'inventory heavy' businesses.

- Failing to make reasonable projections_

- Failing to consider capital expenditures

- Failing to research the industry

- Failing to get help

- Failing to use qualified advisors

- Asking the wrong people for advice

- Failing to do full due diligence

- Sales

Preview Book